Stay 100% FBR Compliant with Xelent Digital Invoicing

Automate your tax invoices, sync with FBR IRIS in real-time, and eliminate manual errors. Built for Pakistani businesses who value compliance and efficiency.

Everything You Need for FBR Compliance

Comprehensive digital invoicing solution built specifically for Pakistan's tax requirements

FBR IRIS Integration

Real-time synchronization with FBR IRIS system for instant invoice validation and submission

Bulk Excel Upload

Upload hundreds of invoices at once using our smart Excel importer with auto-validation

Automated Validation

Automatic invoice validation with detailed error messages and correction suggestions

Tax Calculations

Accurate Sales Tax, Further Tax, and WHT calculations according to FBR rules

Sales & Purchase Invoices

Manage both sales and purchase invoices with complete FBR compliance

Reports & Analytics

Comprehensive reports, tax summaries, and exportable data for audit trails

Role-Based Access

Multi-user support with customizable roles and permission controls

Secure & Auditable

Bank-grade encryption with complete audit trails for all transactions

Cloud & On-Premise

Deploy on cloud for scalability or on-premise for complete data control

Real-Time Insights at Your Fingertips

Monitor your invoicing performance with comprehensive analytics. Track total entries, successful submissions, failures, and tax breakdowns—all in real-time.

- Live StatisticsTrack total, successful, and failed entries with detailed amounts

- Visual AnalyticsInteractive charts showing invoice trends and patterns

- Tax BreakdownDetailed view of Sales Tax, Further Tax, and Extra Tax

- Quick ActionsAdd invoices, filter by date range, and export reports instantly

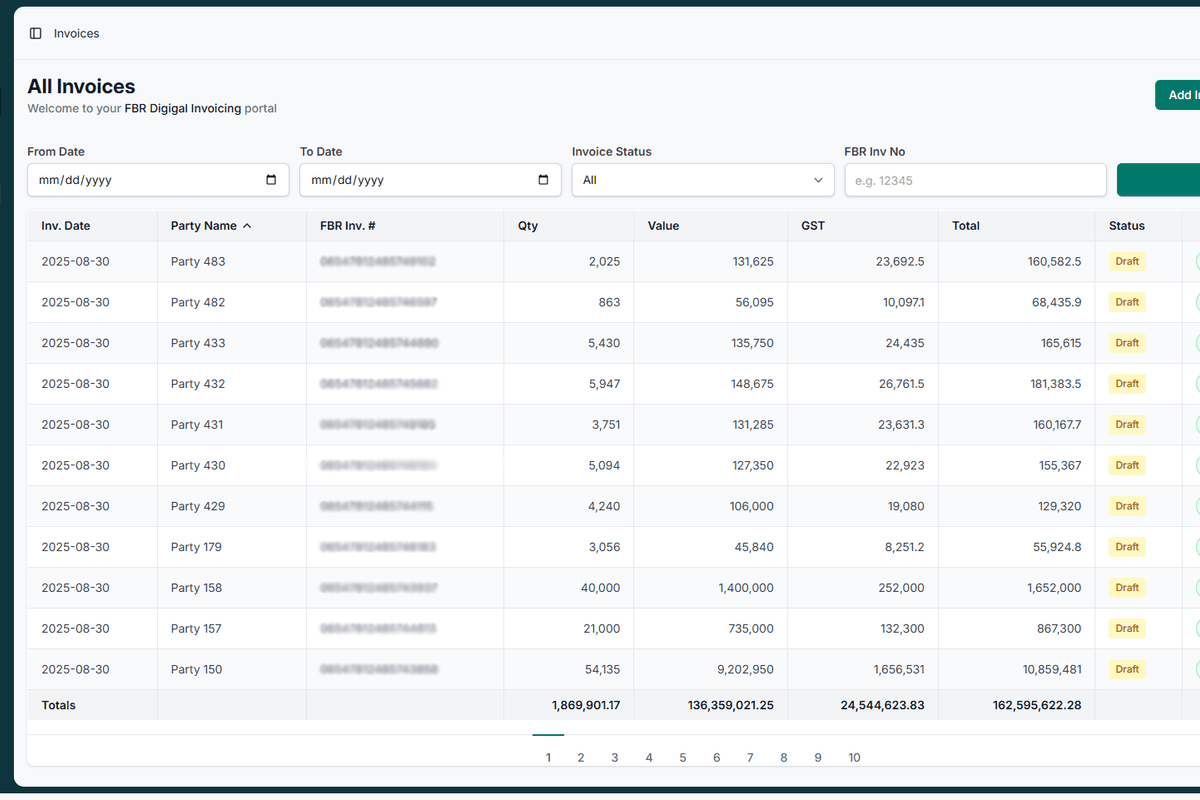

Manage All Your Invoices in One Place

Comprehensive invoice listing with powerful filters, bulk actions, and instant validation status. Everything you need to manage your invoicing workflow efficiently.

- Smart FilteringFilter by date range, status, FBR invoice number, or party name

- Bulk OperationsPost all invoices to FBR IRIS with a single click

- Real-Time StatusSee draft, validated, and failed invoices at a glance

- Quick ActionsValidate, print, and edit invoices directly from the list

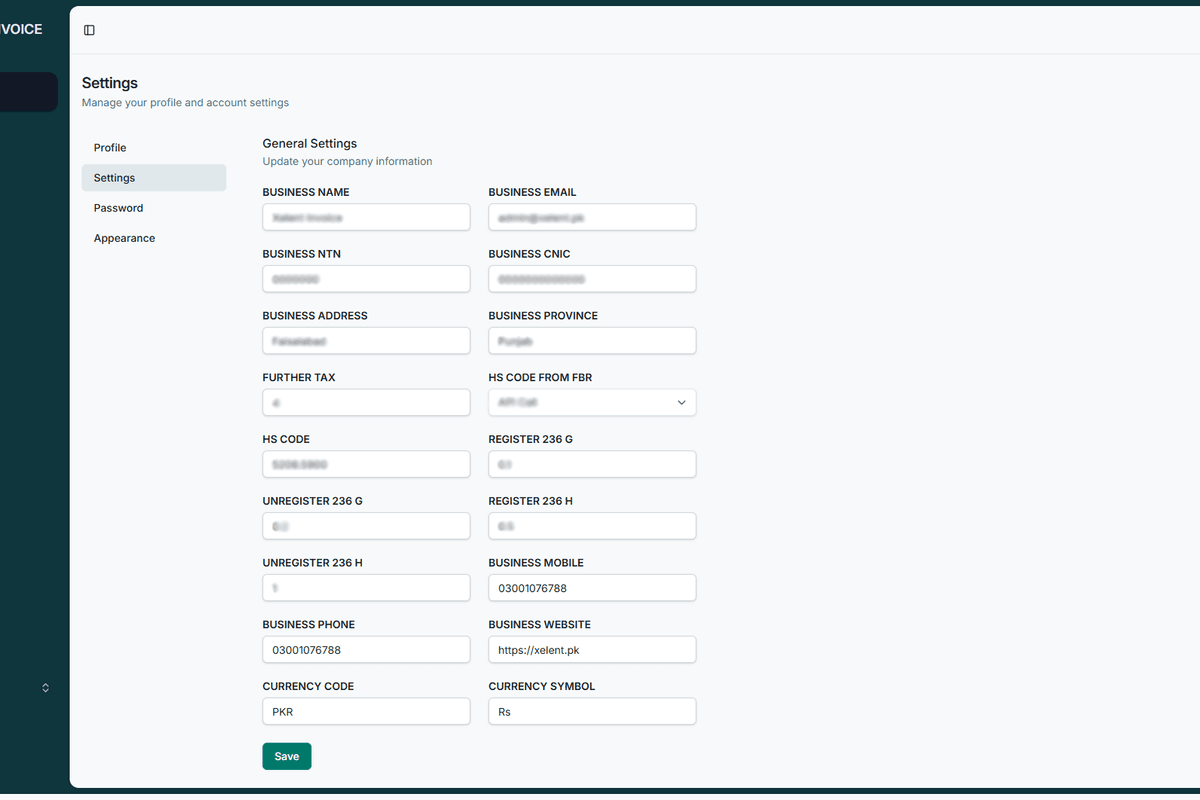

Complete Business Setup & Configuration

Configure your business details, tax settings, and FBR credentials all in one place. Our system handles all the complex tax calculations and validations automatically.

- Business ProfileNTN, CNIC, address, and contact information

- Tax ConfigurationFurther Tax, HS Codes, Register 236 G/H settings

- Currency SettingsSupport for PKR and multi-currency transactions

- User ManagementRole-based access and password management

Ready to Simplify Your FBR Compliance?

Join 200+ businesses already using Xelent Digital Invoicing. Get started with a personalized demo and see how we can transform your invoicing workflow.

Frequently Asked Questions

Got questions? We've got answers

Is this system FBR certified?

Yes, our system is fully integrated with FBR IRIS and compliant with all FBR digital invoicing requirements.

Can I import existing invoices?

Absolutely! Use our Excel bulk upload feature to import hundreds of invoices with automatic validation.

How long does setup take?

Most businesses are up and running within 24-48 hours with our guided setup and onboarding support.

Do you provide training?

Yes, we provide comprehensive training for your team and ongoing support to ensure smooth operations.

What if an invoice fails validation?

Our system provides detailed error messages and correction suggestions. You can fix and resubmit instantly.

Is my data secure?

Yes, we use bank-grade encryption and follow strict security protocols. Your data is safe and private.

Can multiple users access the system?

Yes, with role-based access control. Assign different permissions to different team members.

Do you offer support?

We provide 24/7 support via phone, email, and WhatsApp to ensure you never face any issues.